CFA Classroom > Corporate Transparency Act Compliance

Corporate Transparency Act Compliance

Duration: 60:00

40 million Business Owners will be impacted by this new federal law which requires business entities to disclose personal information and photographs of persons with ownership and control over their business.

Why this matters for you!: From Wall Street to Main Street to your street, the vast majority of private and many nonprofit entities will be swept into Corporate Transparency Act (CTA) compliance.

If you own or control a business entity, you need to pay attention. Not only is initial reporting important, so is ongoing compliance and coordination with other information disclosures you are currently making. We will discuss who is required to report, exemptions, ramifications of ignoring this legislation, as well as answer questions you may have.

What is this law about? If you have not heard of the CTA, you are not alone. Many business owners, executives and their professional advisors, are taken aback upon learning of the CTA’s existence and scope. At its core, the CTA requires reporting of personal direct and indirect beneficial ownership and control information pertaining to businesses operating in the U.S.

Browse By Course Category

Newest Courses

65:19

Patrick Luce, the next ITR Economics personality to present at CFACON, picks up where Conor Lokar left off in 2022. "Prepare for 2024" is his message...

Foundation Certification: Module 11

8:38 | 0.5 PDH/CE/LU

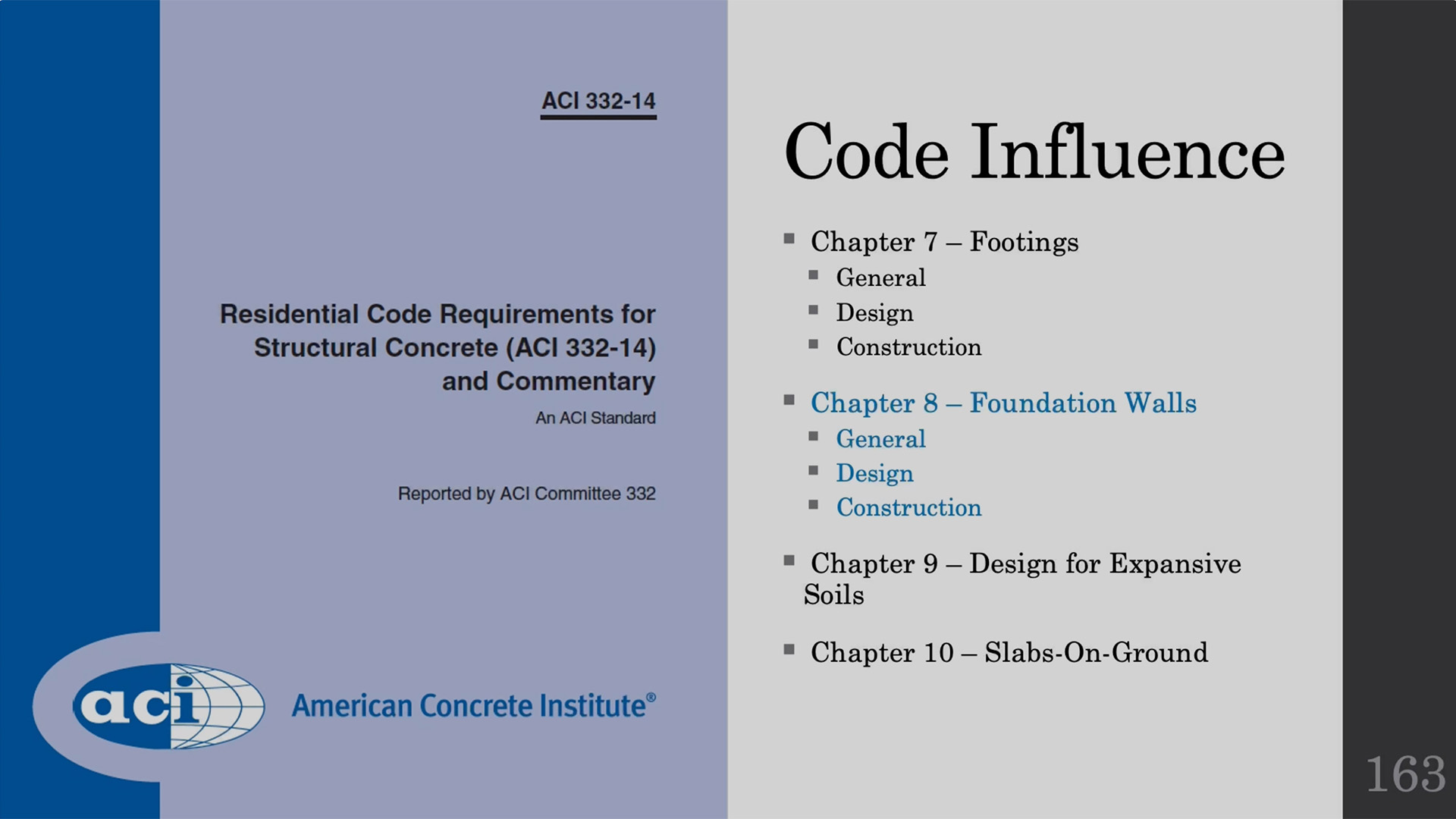

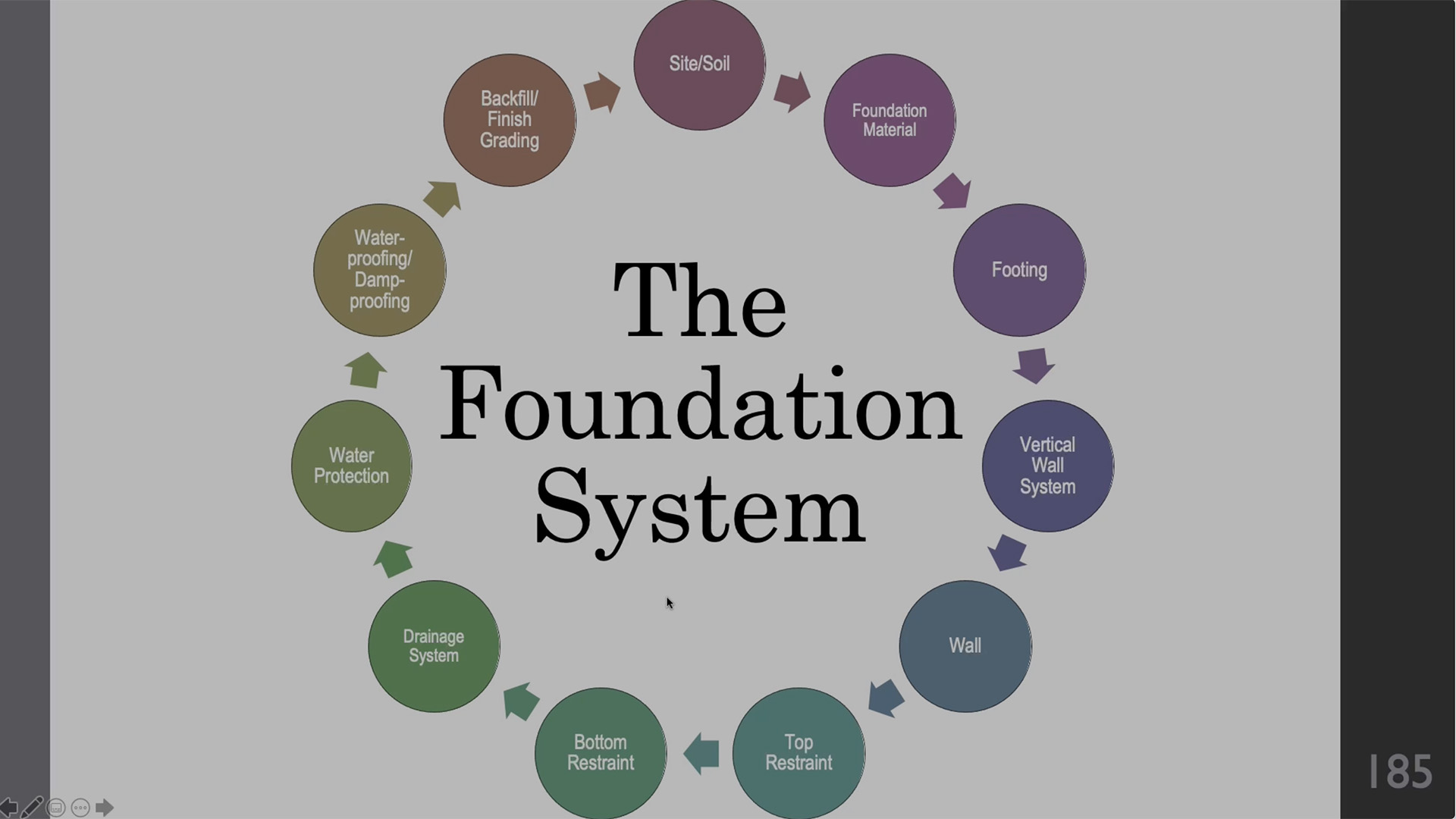

Part 11 of the ACI/CFA Residential Foundation Technician Certification preparatory seminar provides the prescriptive requirements for foundation wall...

Foundation Certification: Module 10

10:42 | 0.5 PDH/CE/LU

This is part 10 of the ACI/CFA Residential Foundation Technician Certification preparatory seminar. This second segment of information on the...

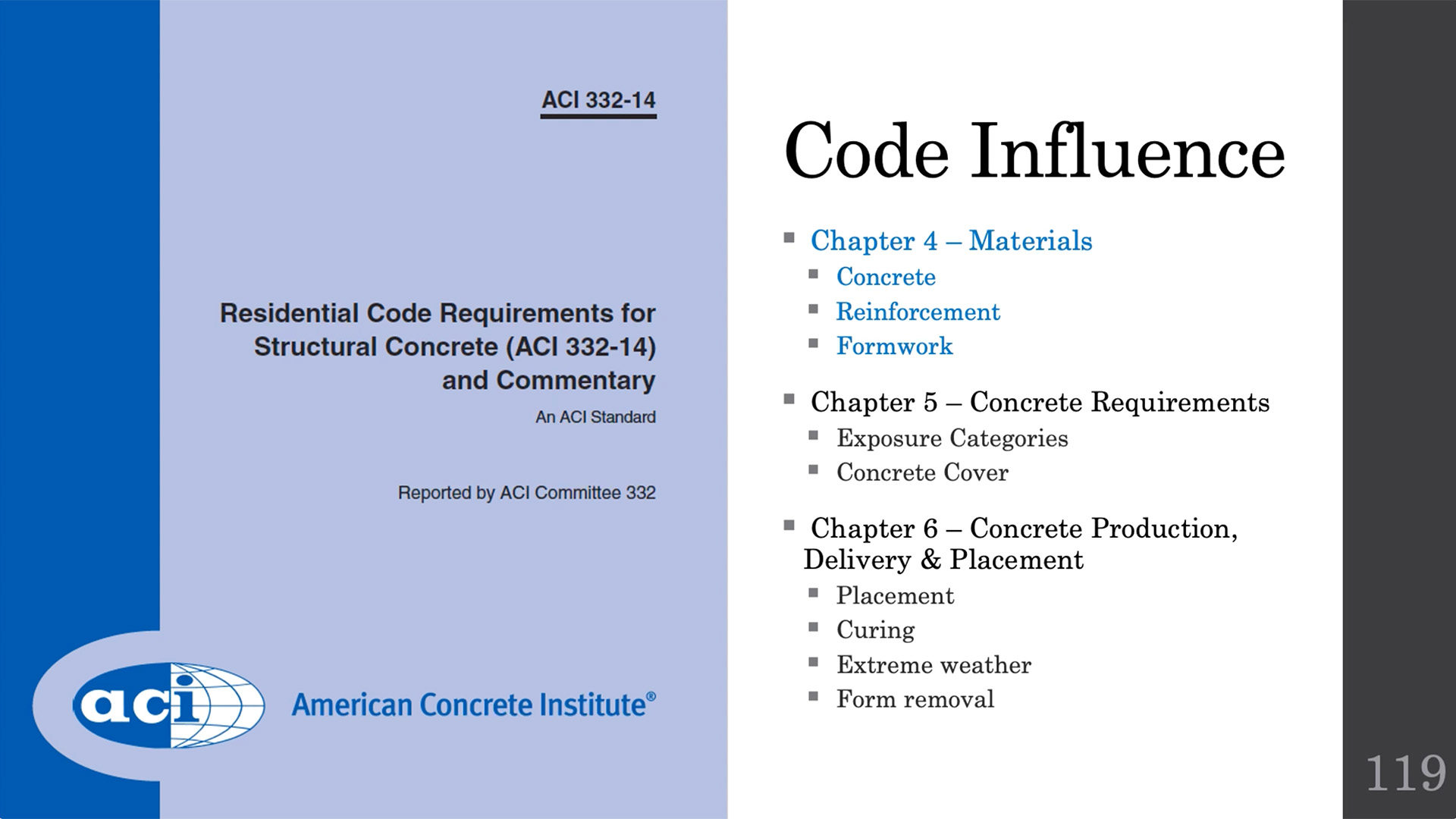

Foundation Certification: Module 13

9:56 | 0.5 PDH/CE/LU

This is part 13 of the ACI/CFA Residential Foundation Technician Certification preparatory seminar dives into the material requirements and unique provisions...

Foundation Certification: Module 14

10:14 | 0.5 PDH/CE/LU

This is part 14 of the ACI/CFA Residential Foundation Technician Certification preparatory seminar. Covered in this session are the detailed aspects...

Foundation Certification: Module 15

10:33 | 0.5 PDH/CE/LU

Part 15 of the ACI/CFA Residential Foundation Technician Certification preparatory seminar wraps up the focus on ACI 332. The foundation wall...

Foundation Certification: Module 16

4:55 | 0.5 PDH/CE/LU

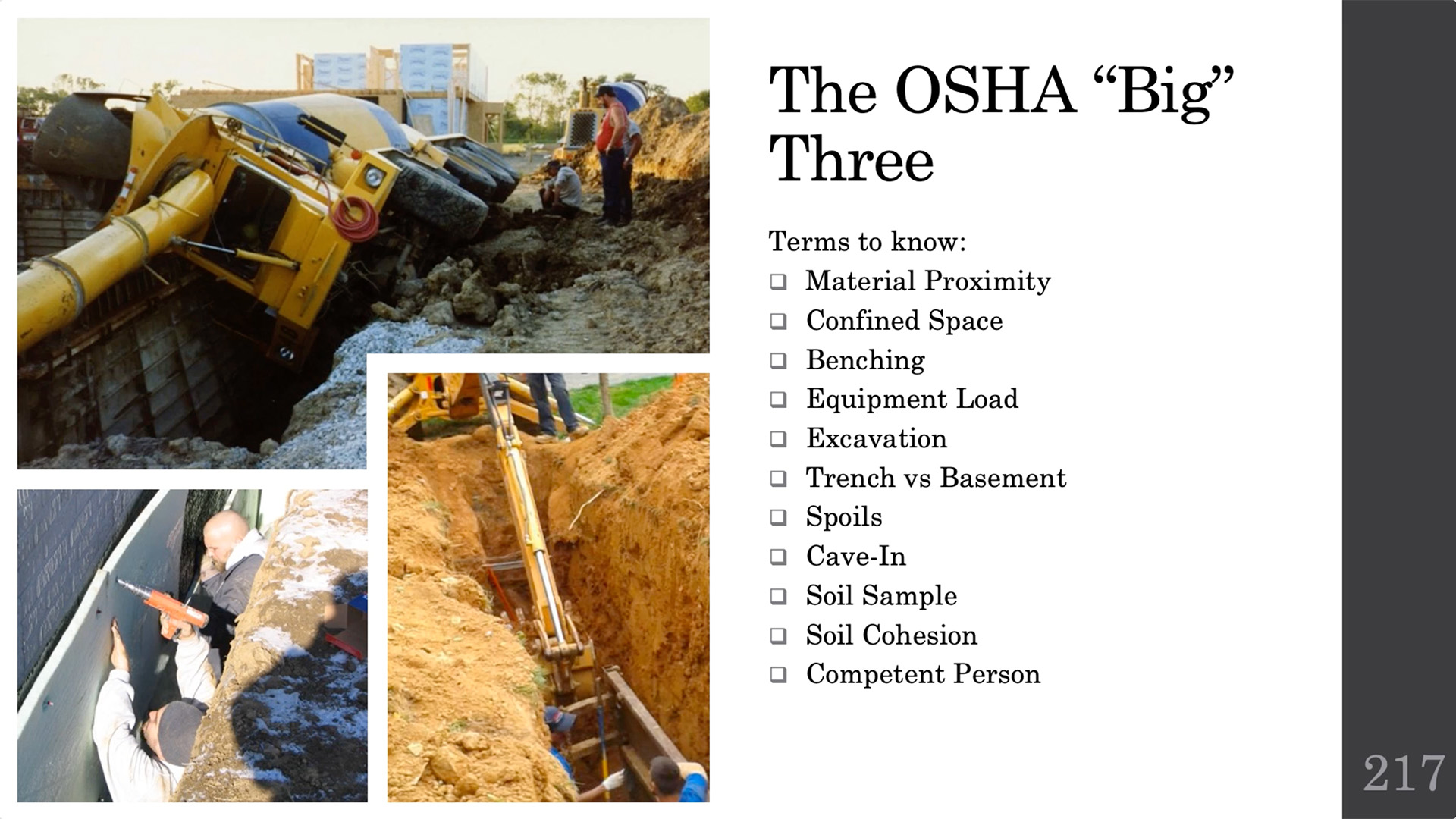

This is part 16 of the ACI/CFA Residential Foundation Technician Certification preparatory seminar. The content of this session covers the application...

Foundation Certification: Module 17

6:37 | 0.5 PDH/CE/LU

Part 17 of the ACI/CFA Residential Foundation Technician Certification preparatory seminar presents important information on finishing the foundation...

Foundation Certification: Module 18

3:55 | 0.5 PDH/CE/LU

This is the final part of the ACI/CFA Residential Foundation Technician Certification preparatory seminar, part 18. Final thoughts for important...